State comptroller: NYC office sector hurting

The state’s comptroller, Thomas DiNapoli, has released a report showing the pandemic wiped out years of growth in New York City’s office sector, erasing nearly $28.6 billion in market value and more than $850 million in property taxes in City Fiscal Year 2022, as employers continue to offer work-from-home options.

“Demand for space led citywide office sector property values to more than double in the decade before the pandemic,” DiNapoli said in a statement, releasing the report. “When the pandemic hit, companies shifted office workers to remote work, rents fell, and vacancies rose. I am optimistic for the sector’s recovery but its short-term future remains uncertain as employers assess future use of the space.”

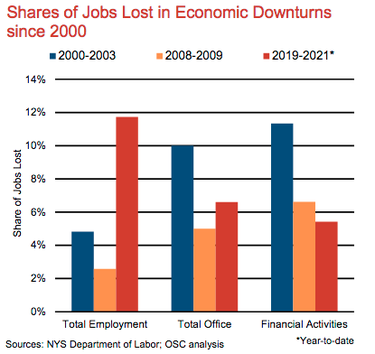

Office employment in the city fell 5.7 percent in 2020, while total employment dropped 11.1 percent, with many shifting to remote work, the report says.

The office sector is responsible for an outsized portion of the city’s economic activity. In 2019, the sector contributed $705 billion (66.2 percent) of the city’s gross product, according to the report. The full market value of office buildings fell $28.6 billion citywide on the FY 2022 final assessment roll, the first decline in total office property market values since at least FY 2000.

Office real estate decline made up 54.9 percent of the reduction in overall billable values (5.2 percent), and more than half of the $1.7 billion decline in property taxes in FY 2022, according to the report. Manhattan alone had 463.8 million square feet of office inventory as of the second quarter of calendar year 2021, accounting for nearly 11 percent of all office space in the nation.

In FY 2021, the office sector provided an estimated $6.9 billion in direct revenue in property taxes, real estate transaction taxes, mortgage taxes and commercial rent taxes.

“The new and prolonged remote work arrangements have raised questions about the future of office space,” states the comptroller’s report. “Employers are assessing how they use shared office space while considering shifts in worker preferences and the feasibility of long-term remote work.

“Some businesses have already instituted permanent hybrid remote-work arrangements, and others are contemplating similar plans. As these developments unfold, the future of office real estate is largely uncertain.”