COVID relief claim for reducing taxes is deliberately misleading

To the Editor:

Why can’t the budget process in Berne be based on legitimate information? Residents have been repeatedly told that the 87-percent drop in taxes for the 2022 budget was an attempt to ease the financial burden on residents inflicted by the COVID pandemic. That is simply not true.

This ridiculous claim was trotted out again in the recent 2026 budget hearing. I sat through that illegitimate hearing under vicious attack simply asking questions. When residents are intimidated and publicly humiliated by elected (and unelected) public officials in a public hearing, one has to wonder if something is being covered up.

The 87-percent tax-rate reduction in the 2022 budget was pure right-wing extremist, anti-government ideology. Our finances are in a mess because Mr. [Dennis] Palow and Mr. [Sean] Lyons blamed the preceding Democrat-led administrations for overtaxing residents for years.

Mr. Lyons was proud to say the reduction would be sustainable long-term. It was not a temporary tax-rate reduction for COVID relief in any way.

I provided a 2021 budget workshop recording to The Enterprise in with a letter to the editor [“Berne GOP tax reduction was inspired by extreme anti-government ideology,” Nov. 7, 2024].

On the recording, Mr. Lyons proposes a permanent, extreme tax reduction and he clearly states that, if anyone increases taxes over the 2-percent tax cap for the next 20 years, they will be doing something very wrong.

Does that sound like a temporary measure to address COVID impacts? Does that sound like he anticipated an 800-percent tax increase two years later?

There was no mention of COVID relief even as a coincidental benefit in his justification for dropping the rate 87 percent!

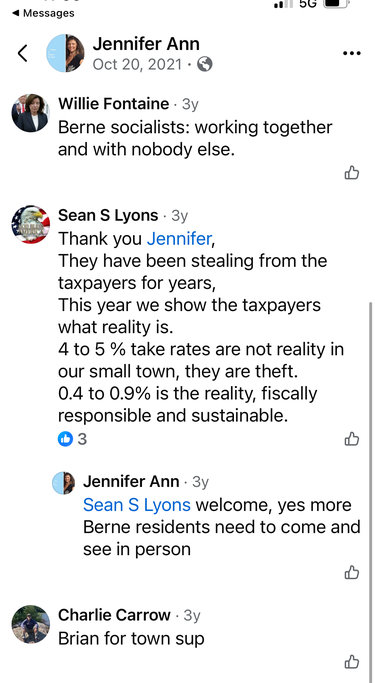

I also provide with this current letter, a 2021 screenshot of a contemporaneous Facebook post by Mr. Lyons blaming the past administrations for “stealing from the tax payers for years” and suggesting he can permanently and sustainably reduce the rate to 40 to 90 cents per $1,000 of assessed valuation to compensate for the overtaxing by previous administrations. That was before the 2022 budget process was complete.

I sat through an illegitimate public 2026 budget hearing that was used by the town board to damage my reputation, question my motivation to comment, and question the legitimacy of my comments instead of providing a free exchange of ideas and concerns regarding the budget and the process as the law requires.

This COVID relief claim is just one deliberately misleading aspect of the 2026 budget process that I can clearly document.

Joel Willsey

East Berne