‘Grossly out of date’ states Barber of law that caused Altamont’s tax hike

GUILDERLAND — The state comptroller’s office on Nov. 26 released its final report on Guilderland’s allocation of sales tax, which includes the town’s rebuttal.

The comptroller found that Guilderland, for the past four years, had not properly allocated sales-tax revenues from the county, to which Guilderland Supervisor Peter Barber responded that the 1965 state law on which the comptroller’s office relies is “grossly out of date.” The town is now providing more services than it did 60 years ago, Barber argues.

The report was not obtainable through the state’s Freedom of Information Law until the Office of the State Comptroller released it.

The audit’s recommendations, which the Guilderland Town Board followed for its 2026 budget, led to an average increase in town taxes for Altamont residents of $240 next year while the average property tax bill in town will decrease by $16, according to the town.

The report confirms what Barber shared at the Nov. 6 town board meeting during which the board adopted, without discussion, a $47.7 million budget for next year.

For years, Barber said, the town has used a “substantial margin of sales tax to reduce the property taxes in the A Fund, which includes the village.” However, the comptroller’s office, he said, determined, “You can’t do it the way we’re doing it.”

Village officials were distressed at the increase and at the lack of communication about it from the town. At the Nov. 18 Guilderland Town Board meeting, Altamont Mayor Kerry Dineen requested that Guilderland’s “financial folks” come to the December village board meeting for a workshop “so we can ask and answer questions.”

That meeting has now been scheduled for Dec. 3 at 6:30 p.m. at Village Hall, which is located at 115 Main St.

The state audit, which covered the period from Jan. 1, 2020 to March 31, 2025, focused on this question: Did Guilderland town officials properly budget for and allocate sales tax revenue?

The 12-page report notes that, during the audit period, Albany County distributed nearly $74.3 million in sales-tax revenue to the town.

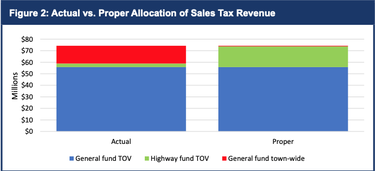

The report concludes, “Town officials did not properly budget for and allocate sales tax revenue totaling $14.8 million, during the audit period. While town taxpayers who lived outside the village did not receive all the benefits they should have from the County sales tax distributions, taxpayers with real property located within the Village received an extra benefit from the County sales tax distributions. As a result, taxpayer inequities occurred.”

Barber said at the Nov. 18 meeting, “By our calculations, village residents over 10 years got over $3,000 in real property tax benefits per household.”

For the 2026 budget, the town followed the comptroller’s recommendations while still contending that the premise is incorrect.

The audit report describes that premise this way: “Sales tax received by a town, which includes one or more villages that receive its own sales tax in cash from the county, must generally be used to reduce taxes for activities levied on property in the town outside such villages, which are accounted for in the town-outside-village (TOV) funds.

“After all such real property taxes are eliminated, then the remaining sales tax balance may be used, among other things, to reduce town-wide (TW) funds’ real property taxes.”

The report also says that Guilderland’s supervisor, comptroller, and fiscal officer “told us they were unaware sales tax revenue was required to be used to eliminate” town-outside-village tax levies before allocating it to the general fund town-wide.

In its corrective plan, the comptroller says Guilderland must allocate its sales tax by reducing “to zero” property taxes levied in the part-town fund before allocating sales tax to reduce taxes in the all-town fund that includes Altamont.

In his four-page response, Barber notes that Guilderland followed this directive in its 2026 budget but says the town board “is mindful of looming expenses in the all-town, like advanced life support services” provided by Guilderland’s Emergency Medical Services, which is provided to all town residents, including those living in Altamont.

Barber takes exception with the “to zero” requirement, citing the section of the New York State Tax Law that requires the town apply its sales taxes only to “reduce” property taxes levied in the part-town funds, without requiring a reduction to zero.

“While there are several State Comptroller’s opinions that, not surprisingly, support its position, we are not aware of any court decision that interprets this statute,” Barber writes.

In light of this, The Enterprise asked Barber if Guilderland would consider legal action. Barber responded in an email, “I am not aware of a method for challenging an OSC [Office of the State Comptroller]’s audit report in court.

“The most common route for challenging a State’s order etc. is a special proceeding under CPLR [Civil Practice Law and Rules] Article but with no order or its equivalent, I’m not sure how it would apply in this situation.

“It might explain why there are no court decisions on this statute or with regard to OSC audit reports. A possible option is legislation that gives Town Boards the discretion to use its sales tax allocation in the best interests of its residents.”

Barber’s written response to the report continues, “The Legislature chose the word ‘reduce’ which is defined in Merriam-Webster Dictionary as ‘to diminish in size, amount, extent or number,’ such as ‘reduce taxes.’ The Legislature could have, but did not use words such as ‘eliminate,’ ‘exhaust,’ ‘reduce to the maximum extent possible,’ ‘reduce to zero,’ or any other absolute phrases,” he writes.

Barber also responds to the report’s statement that, over four years of budgets, the town board improperly applied $14.8 million of its sales tax to reduce general town taxes in the all-town A Fund that includes Altamont, causing “taxpayer inequities.”

“The Report fails to note,” Barber responds, “that the A Fund’s general tax includes the entire Town, and the Village is only about 3.5 percent of the Town’s total real property tax value.”

So, Barber maintains, over four years, only about $518,000 — or $128,500 per year — was applied to town taxes on properties in the village.

“The overwhelming reduction (approximately 96.5 percent or $14.3 million) in general Town taxes benefitted property taxpayers outside the Village,” Barber writes. “This striking disparity in size between the Town and Village is far different in other municipalities, such as the Village of Voorheesville which is 31.1 percent of the Town of New Scotland’s population.”

Barber goes on to note that, since the tax law was adopted in 1965, there has been no statutory change in how sales tax should be allocated. He argues that the comptroller’s “reduce to zero” insistence “fails to appreciate dramatic changes in the services provided by the Town and Village over the past 60 years.”

Barber goes on to state that changes since 1965, including more robust senior services, animal control services, and information-technology services, which the town now provides to all of its residents, including those who live in the village of Altamont.

At the same time, he writes, volunteers provided ambulance services in 1965, while the town’s EMS department was appropriated over $4 million in the 2025 budget, an amount that increases every year.

The Guilderland Town Board exercised its discretion, as allowed by law, Barber writes, to apply its sales taxes to support this all-town A Fund EMS department in approved budgets.

“The average yearly budget allocation of about $129,500 in Town sales tax over four budget years to support EMS’s advanced life support services to Village residents was a prudent action,” Barber writes.

He concludes, “Simply put, the statutory scheme for restricting the Town Board’s use of allocated sales taxes is grossly out of date. It fails to recognize how Town and Village services have evolved over the past 60 years to meet the community’s needs, and, if rigidly applied, would unnecessarily hamper the Town Board’s ability to provide essential services to all Town residents, including those Town residents living in the Village.”