Guilderland school district sets corrected tax rates

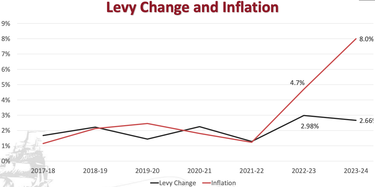

— Graph from GCSD School Board agenda for Aug. 15, 2023

Since 2017, the Guilderland school district has kept the levy change in line with inflation until last year when inflation went from the usual 1 to 3 percent, skyrocketing to 8 percent this year, said Assistant Superintendent for Business Andrew Van Alstyne, who presented this graph to the school board.

GUILDERLAND — The school board here met on Wednesday, Aug. 23, to officially adopt corrected tax rates for the 2023-24 school year. The vote was unanimous.

The rates the Guilderland School Board had adopted on Aug. 15 had been based on an error on the assessed valuation for Guilderland properties, which had been the starting point for calculations, the district’s assistant superintendent for business, Andrew Van Alstyne, told The Enterprise this week.

The lion’s share of the district falls in the town of Guilderland with an assessed value of close to $4 billion. Of the roughly $80 million to be raised in property taxes for this year’s $120 million school budget, about $74 million will come from Guilderland. The district is receiving about $38 million in state aid.

Guilderland residents will pay $18.62 per $1,000 of assessed value, which is a 2.3-percent increase over the previous year. When voters went to the polls to pass the school budget last May, the district had predicted a 2.66-percent increase.

While Guilderland’s rate increase is slightly less than predicted, property owners in the parts of the other three towns served by the district will see a greater-than-predicted increase. This is because the assessed valuation in Guilderland has declined, leaving taxpayers in the other towns to make up the difference.

The tax rate for each town is calculated using a state-set equalization rate so that like properties, even if they are located in different municipalities within the same school district, pay similar amounts.

Van Alstyne had told the school board on Aug. 15, “Often, the further you are out from the time that evaluation was done, the more change or swing there can be in the equalization rate.”

Small portions of the district lie in three towns besides Guilderland:

— Bethlehem, which will pay about $6 million of the levy, has a rate of $21.10 per $1,000 of assessed value. That is an increase of 9.57 percent over the previous year.

Van Alstyne explained that the increase for Bethlehem property owners is larger than for property owners in other towns because Bethlehem — with $269,000 in assessed valuation — is paying a larger share to make up for Guilderland’s decrease in assessed valuation;

— New Scotland, which will pay about $333,000 of the levy, has a rate of $21.39 per $1,000 of assessed value, which is a 4.6 percent increase over the previous year; and

— Knox, which will pay about $578,000 of the levy, has a rate of $40.58 per $1,000, an increase of 2.91 percent over last year.

Guilderland last went through town-wide revaluation four years ago and has an equalization rate of 85 percent. Bethlehem, which last revalued nine years ago, has an equalization rate of 75 percent. New Scotland last revalued 17 years ago and has an equalization rate of 74 percent while Knox hasn’t revalued since 1997, which was 26 years ago, and has a state-set equalization rate of 39 percent.

The state releases municipal equalization rates after school budgets are voted on, Van Alstyne told the board on Aug. 15, so districts don’t have those numbers to make tax-rate predictions for residents ahead of the state-set May voting date.

While the Guilderland Public Library elects its own board and sets its own budget, its lines follow the school district boundaries and the school board on Wednesday set the library tax rates as well. The breakdown of property in the four towns is the same as for the school district.

The library has a much smaller budget, at $4.3 million with a levy of nearly that much since, unlike the school district, the library does not get a big chunk of state aid.

These are the library tax rates for 2023-24 for the parts of the four towns within the district lines:

— The Guilderland rate is 99 cents per $1,000 of assessed value to cover its $3.9 million levy;

— The Bethlehm rate is $1.13 per $1,000 to cover its $303,000 levy;

— The New Scotland rate is $1.43 per $1,000 to cover its $18,000 levy; and

— The Knox rate is $2.17 per $1,000 of assessed value to cover the $31,000 tax levy.

School and library tax collections start on Sept. 1 and conclude on Oct. 31.

In its resolution passing the tax warrant on Aug. 23, the Guilderland School Board agreed to “retain as surplus funds $4,790,888 from the fund balance of $4,790,888 thereby applying $0 to the reduction of the tax levy.”

Van Alstyne noted to The Enterprise this week that that figure is 4 percent of next year’s budget, which is the maximum that the state allows a school district to keep as its fund balance or rainy-day account.

Van Alstyne noted this week as he had a previous board meeting that, among the Suburban Council school districts with which Guilderland compares itself, Guilderland has far fewer reserves, something several school board members have expressed concerns over in the past.

“It’s best practice to have reserves sufficient for long-term needs,” Van Alstyne told The Enterprise this week.