Governor’s large school-aid proposal fits GCSD plans

GUILDERLAND — On Tuesday morning, Governor Kathy Hochul presented her budget with $31 billion in school aid, the most ever, which is a $2 billion increase, or 7 percent, over the current year’s aid.

Guilderland’s assistant superintendent for business, Neil Sanders, said on Tuesday afternoon that the district is “very pleased” with Hochuls’s proposal although he won’t see numbers specific to Guilderland for a day or two.

“We’re also going to invest in education, strengthening our teacher workforce and supporting students’ mental health,” said Hochul in presenting her budget.

Last week, Guilderland’s school board president had said that mental health and social-emotional learning were important across the board to everyone.

In early December, Sanders had projected a rollover budget for next year at $109 million, up $4 million from this year.

The rollover budget keeps all staff and programs the same as this year. Keeping those constant, spending would increase by $4.1 million, which is a 3.9 percent increase over this year.

Revenue is expected to increase by $2.8 million, which is a 9.7 percent jump.

The biggest factor in the revenue jump is the state’s commitment to make Foundation Aid to schools whole, said Sanders. After many years of the state not fulfilling a court order, last year the legislature made good on the owed funds.

Tuesday is the first time the funds have been part of the executive budget. In 1993, the Campaign for Fiscal Equity argued successfully in court that some students were being deprived of the constitutional right to a sound basic education due to inadequate state funding.

Foundation Aid is to be restored over three years. Guilderland got an additional $1.5 million this year and is slated to get $2.15 million next year and the following year, too, Sanders said on Tuesday.

Foundation Aid is the state’s main education operating aid formula, based on student need, community wealth, and regional cost differences. Hochul’s budget provides a $1.6 billion increase in Foundation Aid, an 8-percent increase, supporting the second year of the three-year phase-in of full funding of the current Foundation Aid formula; each school district is to receive a minimum year-to-year increase of 3 percent.

“It looks like that three-year phase-in, at least from the governor’s perspective, is going to happen, so that’s tremendous news for our school district and school districts throughout the state,” Sanders said on Tuesday.

Last May, Guilderland Superintendent Marie Wiles said, “This infusion of Foundation Aid and state aid to Guilderland is a lifeline, truly. It means that we can maintain our programming and also expand our programs in areas where we have the greatest need.”

State aid for Guilderland schools is projected to total $31 million next year while property taxes are to pay for $77 million.

The projected tax levy increase of $1.3 million, or 1.7 percent, would stay under the state-set levy limit of $1.9 million.

For the first time since 2019, property tax levy growth for school districts will be capped at 2 percent, up from 1.23 percent last year, according to data released last Wednesday by State Comptroller Thomas DiNapoli.

The tax cap, which first applied to local governments and school districts in 2012, limits annual tax levy increases to the lesser of the rate of inflation or 2 percent. DiNapoli’s office calculated the inflation factor at 4.7 percent for those with a June 30, 2023 fiscal year end.

School districts may override the cap with 60 percent voter approval of their budgets. Guilderland has never proposed a budget over the state-set levy limit, and doesn’t plan to this year.

“Even with significant funding from the state and federal governments, school and local communities are faced with the rapid increase in inflation, pandemic surge, and trying to retain and recruit employees,” said DiNapoli in a statement as he released the data.

In making her budget presentation on Tuesday, Hochul said of the increased school aid, “This should be used to continue expanding our pre-K program to school districts all across the state, and for much-needed after-school programs because working parents need all the support they can get.”

Guilderland started its first pre-kindergarten program this school year when it was surprised to be allocated $626,400 for that purpose. The district interviewed outside providers since there was not enough classroom space or in-house staff to provide the new service. A lottery was held because more parents were interested than the 116 spaces available, which is about half of the district’s kindergarten enrollment.

“The intent from last year was two years of funding so the plan would be to continue that again next year …. Certainly, it’s an asset for the community,” said Sanders on Tuesday. “It’s funded, which is wonderful for parents and we look forward to seeing where that goes under this new proposal.”

Wiles is slated to present Guilderland’s draft budget on March 8, taking into account suggestions from both board members and the community through an online ThoughtExchange.

The deadline for the legislature to finalize the state budget is April 1.

School district voters will have their say in May.

A primer on reserves

Sanders presented a primer on fund balances and reserves at the school board’s Jan. 11 meeting. Unassigned fund balance, or a rainy-day account, can’t exceed 4 percent of the following year’s budget, he explained. Some or all of the fund balance may be spent as revenues in an annual budget.

Four categories of fund balance are required by law:

— Assigned, set aside to pay year-end bills. For this coming year, there’s not an updated figure for the assigned fund balance yet, Sanders told The Enterprise on Tuesday;

— Appropriated, designated to lower taxes. As part of the budget-adoption process by the school board members in April, Sanders said this week, they decided how much, if any, should be appropriated;

— Restricted, set aside to pay for legally allowed expenses, which totals $7.7 million. Most of that — about $5 million — is for retirement contributions with other accounts including, in descending order, tax certiorari, employee benefit liability, workers’ compensation, capital reserves, unemployment, and repairs; and

— Unassigned, contingency for emergencies, which is currently $4.2 million for Guilderland.

A school district may set aside reserve funds in 13 designated categories. Sanders explained that reserve funds are “tied to a particular purpose” and in some cases need voter approval.

He also went over the advantages and drawbacks of fund balances and reserve funds.

On the plus side, Sanders said, they provide flexibility in the midst of financial instability; they let the district meet unanticipated needs without having to borrow; they lead to a higher credit rating so the district can borrow at lower interest rates; and they contribute to tax-rate and budget stability.

On the downside, Sanders said, continued use of reserves creates a revenue gap, requiring cuts to balance the budget; rising costs or loss of revenue may need to be funded through borrowing or through a budget freeze; and, if not carefully managed, using these funds to balance the budget can cause long-term bad consequences.

Sanders displayed a bar graph that showed how, because of the Great Recession in 2008 and 2009, the school district lost a significant amount of state aid. “We needed to use our savings … six years later, it was about half,” said Sanders.

In the 2007-08 school year, Guilderland had a fund balance of $11.4 million, which steadily declined to $4.8 million in 2013-14. Because of the state-set levy limit — 2 percent or the consumer price index, whichever is lower — budget cuts needed to be made.

The state comptroller labeled Guilderland as “susceptible to fiscal stress” for two years in a row, which led to a lower bond rating and therefore higher borrowing costs.

Before the 2008 recession, for several years in a row, Guilderland was cited in its annual state-required audit for having a fund balance that was higher than the percentage allowed by law; a majority of board members at the time felt that was prudent so that the district could be prepared for an emergency and also could meet payroll without borrowing if state aid payments were delayed.

After the recession, the board was willing to use more of the fund balance to keep the tax-rate down and to avoid cutting more staff and programs.

“We’re in a financially turbulent time right now,” Sanders said at the Jan. 11 board meeting.

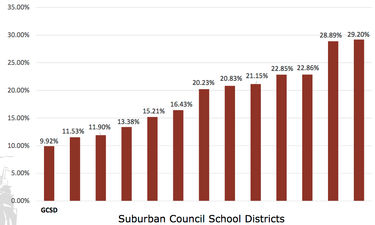

He displayed another bar chart, showing Guilderland’s fund balance as a percentage of 2020 expenses compared to each of the other Suburban Council schools. Guilderland had the lowest percentage at 9.92; the highest percentage was over 29 percent.

“We have less tools,” said Sanders, to work through a financial crisis.

Sanders then made the case for maintaining an adequate level of fund balance, saying that it smooths out year-to-year fluctuations, allowing a “strong, robust education over time.”

He said that keeping funds in reserve is not taking money away from taxpayers but rather avoiding cycles of budget and staff reductions, class-size increases, and limited options for extracurricular activities.

With inflation now over 4 percent, Sanders said, the district still has to come under the 2-percent state-set levy limit.

He also said that an adequate fund balance maintains a strong tax base, leading to “a strong vibrant community,” which is good for real-estate values.

Board views

At the board’s Jan. 11 meeting, President Seema Rivera said it was not surprising that ThoughtExchange comments showed mental health and social-emotional learning were important across the board to everyone.

Wiles said the district is working to make staff adjustments so be sure there is a counselor in each of Guilderland’s school buildings. She also said it has been difficult to find a replacement for the clinician form Northern Rivers who had worked at the Farnsworth Middle School clinic.

The position, in great demand, has been empty for a couple of months, Wiles said, but a replacement is expected “any day now.”

“When it’s up and running, it’s made a big difference for the families that use it,” she said. In the absence of a clinician, a waiting list has been kept.

Board member Blanca Gonzalez-Parker said she was “alarmed to hear” the ratio of students to social workers and wanted to know what the students think.

Board member Barbara Fraterrigo asked about increasing the district’s co-teaching model, in which students with disabilities learn alongside regular students in a classroom with two teachers.

Wiles said the co-teaching model was used in kindergarten through 12th grade at Guilderland but, in elementary school classes where there are not enough students in a particular grade level with similar disabilities, a consultant model is used. Otherwise, she said, “The cost would be quite extraordinary.”

Fraterrigo also wanted to know how many students apply for the lottery each year to be chosen to study at the regional Tech Valley High School. She suggested making another slot available.

Rivera asked about the shortage of bus drivers. Sanders said, although office staffers still have to drive sometimes, it’s “much better than it was.” CDL requirements were made easier by the state, Sanders said.

The state’s Department of Motor Vehicles expedited the process for obtaining a Commercial Driver License, or CDL, by removing the 14-day waiting period between the permit test and the road tests. The state also increased capacity to administer road tests and, through cooperation with county-operated motor-vehicle offices, increased testing capacity for written exams.

New York also opened new CDL driver-testing sites by partnering with SUNY, the Thruway Authority, the New York Racing Association, and the Office of General Services to use large lots on their various sites for the road test. For school staff who held an existing CDL, the state set up expedited testing to obtain a permit that allows them to drive vans and buses temporarily.

A new proposal would allow qualified third parties to offer the road tests, which would create more testing locations statewide and expand capacity. The state’s Department of Motor Vehicles will hold a public hearing on that initiative on Jan. 26.

Other business

In other business at its Jan. 11 meeting, the school board:

— Heard from Wiles that a “full search” will be conducted for the district’s newly created administrative post, director of technology. She called the post “critical” and said she appreciated the board’s support for the position. The director is to be named on or about April 1.

The late Demian Singleton, whose title was assistant superintendent of curriculum and instruction, had also served as the district’s technology director. That post also will be filled this spring, Wiles said, as will the post of Lynnwood Elementary School principal, currently filled with an interim principal;

— Authorized Wiles to execute a memorandum of agreement between the district, the Guilderland Teachers’ Association, and Louis Marino;

— Learned that the district will receive energy incentive rebate checks totaling $61,086 from National Grid. The rebates were applied for in conjunction with boiler replacements, window replacements, and added roof insulation. The incentives are to encourage less use of natural gas. Facilities Director Cliff Nooney anticipates multiple future applications for windows; insulation; boilers; heatitin,ventilation, and air-conditioning equipment and controls — all associated with the district’s current and recently approved capital projects; and

— Heard that eight Guilderland students have been recognized by the New York State Band Directors Association. Selected to perform in the High School Honor Band are Olivia Petti on oboe, Karsen Rittner on clarinet, and Bailey Yerdon on percussion. Performing with the Middle School Honor Band are Anthony Padula on French horn, John Wang on clarinet, and Sam Woo on trumpet. Austin Li on oboe was recognized as an alternate. Performing in the Jazz Ensemble is Landon Kinal on trumpet.