New GCSD biz leader makes the case for a bigger fund balance

GUILDERLAND — The school district here needs $4 million more in its rainy-day account to be at the same level as its peer districts in the Suburban Council, according to Guilderland’s new assistant superintendent for business, Andrew Van Alstyne.

As the school board begins building next year’s budget, Van Alstyne gave an overview of the district’s fund balance and reserves to the board at its Jan. 10 meeting. The board is slated to hear the superintendent’s draft budget proposal on March 7, and voters have their say in May.

A fund balance, Van Alstyne explained during the televised meeting, is the end-of-year surplus in the general fund that may grow over time. By state law, a fund balance cannot exceed 4 percent of the next year’s budget.

Guilderland’s current budget is $110 million, and a rollover budget — keeping the same staff and programs — for next year would total $118 million, the board was told in December by its former business administrator, Neil Sanders. That represents a roughly 7 percent increase in spending, which, with additional state aid, would result in a tax levy increase of 2.2 percent, Sanders had estimated.

Van Alstyne distinguished a fund balance from reserve funds; in New York, there are 13 categories for which a school district may set aside funds such as for retirement contributions or workers’ compensation.

Reserve accounts and a fund balance, he said, allow a district to deal with financial instability and to meet unexpected needs without having to borrow. Also, Van Alstyne noted, it gives the district a higher credit rating, which means the rates for borrowing are lower.

There are pitfalls in using a fund balance or reserve accounts to balance a budget, Van Alstyne cautioned. “The metaphor we use is a fiscal cliff,” he said. Continued use of these funds to balance a budget creates a gap that ultimately leads to budget cuts.

Illustrating his point with a graph, Van Alstyne showed how Guilderland used its fund balance from 2007 to 2009 during the Great Recession to “minimize the damage to the district.”

For the school year that started in 2007, Guilderland had a fun balance of $11.4 million. By the time the 2010 school year started, the fund was down to $8 million. It steadily declined to $5.8 million for the 2013-14 school year.

In the school years that started in 2013 and 2014, Guilderland was designated by the state comptroller’s office as being “susceptible to fiscal stress.” This led to a lower bond rating — Guilderland went from Aa3 to A1 — resulting in higher borrowing costs. Coupled with the state’s tax-levy limit, this can lead to budget cuts, said Van Alstyne.

Presenting a list of Guilderland’s current fund balance and reserves, Van Alstyne noted the unassigned fund balance is now at about $4.4 million and, among the reserves, the one for tax certiorari is down to zero.

In the wake of Guilderland’s 2019 town-wide property revaluation, the school district was hard hit as the town’s assessments have been challenged; the school district this past summer borrowed to pay refunds.

“There are more on the horizon,” said Van Alstyne of tax challenges.

Other Suburban Council school districts have about 15 percent of their spending in reserves, said Van Alstyne, while Guilderland has less.

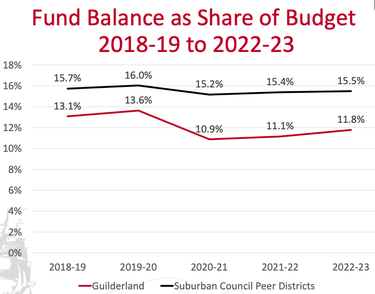

Pointing to a graph showing, over time, Guilderland’s fund balance as a share of its budget, Van Alstyne said, “Here we see the pandemic hit our reserves much harder than the overall Suburban Council.”

The graph showed a marked dip for Guilderland from 2020 to 2021, with the fund balance dropping from 13.6 percent to 10.9 percent. That has gradually increased to 11.8 percent this school year. But throughout, Guilderland has been below its Suburban Council peers, which are in the range of 15 to 16 percent.

Guilderland’s fund-balance gap has increased from $2.46 million in the school year that started in 2019 to $4.09 million this school year.

“Why is this the starting point of our financial planning?” Van Alstyne asked, answering himself: “Because this is our best tool in dealing with challenges that arise and in making long-term plans.”

Van Alstyne stressed that an adequate fund balance lets the district smooth out year-to-year fluctuations, maintaining robust educational programs. It also avoids cycles of budget cuts — such as for staff and teachers, increasing class sizes, or for extracurricular activities like sports.

An adequate fund balance also gives the district, working under the state-set levy limit, more flexibility, and, said Van Alstyne, it maintains “a strong tax base leading to a vibrant community with rising property values.”