Mayor: ‘I don’t think this increase should stand’

GUILDERLAND — Supervisor Peter Barber opened the Nov. 18 town board meeting by addressing “the quandary” of a steep tax hike for Altamont residents in the 2026 town budget.

The Enterprise broke the news in a story, “Town taxes to jump 162% for Altamont residents,” on Nov. 7, the day after the town board unanimously adopted, without discussion, a $48 million budget for next year, noting in the first sentence that the average property tax bill in town would decrease by $16 while, for Altamont residents, it would increase by about $240.

The article went on to explain that the hike was caused by a comptroller-directed shift in how sales-tax revenues — the major source of income for municipalities in Albany County — could be allocated.

While town board members on Nov. 18 defended and explained their handling of the situation, calling The Enterprise headline “misleading” and “salacious,” Altamont’s mayor, Kerry Dineen, commended the coverage, which allowed both boards to submit their views.

Dineen said the news story was how she and board members learned of the tax hike, and she called for changes going forward. “I don’t think this increase should stand,” Dineen said.

Town Councilwoman Amanda Beedle called for regularly scheduled meetings between town and village leaders.

Barber explained that the state comptroller’s office had started an audit in January, submitting a draft report to the town board on Oct. 1, which had to be kept confidential until the final report was released.

“The final report has not been released,” said Barber, noting it is not subject to Freedom of Information Law requests.

The comptroller had determined that the budget could not use any sales-tax revenues to fund “any department activities in the village of Altamont,” Barber said. “That’s because the village of Altamont gets its own sales tax … They basically said, ‘If you use sales tax in the village, they’re getting a double benefit.”

As Barber told The Enterprise for the Nov. 7 story, the town has objected to the decision but nevertheless must follow it.

Barber went on, “By our calculations, village residents over 10 years got over $3,000 in real property tax benefits per household.”

Barber had referenced Altamont’s tax hike in his comments at the Nov. 6 budget hearing and included information about it in projected slides.

“The state comptroller was not happy with our PowerPoint to a certain extent because we were sharing information that they felt was still confidential,” he said on Nov. 18. “But to reduce any impact on village residents, the town’s 2026 budget uses $1.3 million in fund balance and reserves to support department activities within the village.”

He went on, “The headline saying 162 percent is misleading; it only impacts the town’s share of the village total tax bill.”

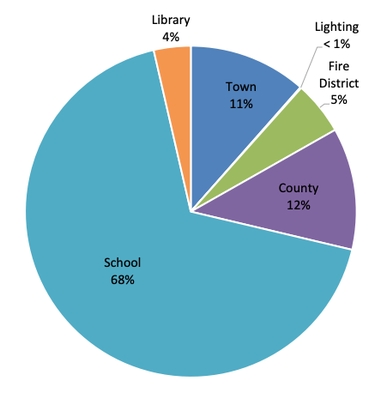

The Enterprise’s Nov. 7 story included this information: “town taxes make up just 11 percent of property owners’ tax bills; school taxes account for 68 percent, county taxes for 12 percent, fire-district taxes for 5 percent, and library taxes for 4 percent.”

Barber then went over the arithmetic for Altamont residents to calculate their tax hike: “Basically you take the last year’s tax rate and this year’s tax rate — the difference is about 86 cents per $1,000 [of assessed valuation] … and you multiply it by roughly 86 cents and divide that by 1,000. That’s third-grade math, maybe fourth-grade math.”

Barber said of the town’s rebuttal to the comptroller, “We think we’re correct. But until we can convince the comptroller, we have to basically abide by the guidance that they provided us … It’s a complicated area; it’s frustrating. It’s difficult when you have a confidential requirement and you also want to share as much information as possible at public hearings.”

Councilwoman Beedle, who lives in Altamont, said, “I help represent this town in its totality, not Altamont in its singularity. I am just as impacted as the rest of us.”

Alluding to the Enterprise story, Beedle went on to say, “There was a salacious 162-percent headline that led people to panic, rightfully so …. It sounded scarier than what ends up breaking down.”

She also said, “Peter tried to fight. Our budget officers tried to fight them. And, if we don’t lie in compliance, we’re going to keep getting dinged on our audits. And that’s something that I don’t think the town in its totality wants.”

Beedle concluded by calling for scheduled monthly meetings between town and village leaders.

“What transpired last week was disheartening,” Beedle said, “because it was a breakdown of communication between two of our municipal leaders.

Later, she shared calculations for her own Altamont home, with an assessed value of $241,000. Next year, she will see an increase of $207.26 over this year’s tax bill, which breaks down to $17.27 more per month than she paid last year.

Deputy Supervisor Christine Napierski said, “I think people see a headline for 162-percent increase and of course they’re going to be upset, especially with cost of living rising so rapidly these days and so much stress going on in our lives so hopefully we can explain it so that people will understand …

“Maybe we could have done a better job getting out ahead of the story but there was never any intention not to tell people about it …. I just hope that people will listen and hear the full tale, the full side of our story before they jump to any conclusions.”

Mayor’s view

Altamont’s mayor, Kerry Dineen, said she and the other village board members learned about the tax hike from the Nov. 7 Enterprise story. It was sent to her by two different trustees, she said, asking, “What is this? Did we miss something?”

Dineen went on, “And I said, ‘I don’t know anything about this.’ So hence our letter to the editor [“Why didn’t the town alert us?” The Altamont Enterprise, Nov. 13, 2025] … We work really hard to be so transparent with our village residents and we didn’t want them to think that we did not tell them something.

“We just wanted them to know we don’t have any answers, we don’t know anything yet. That’s why we wrote a letter.” She noted that the Enterprise editor shared the letter with Barber so the town could respond.

“Then you guys wrote a letter in response to that [“We hoped the comptroller would agree with us,” The Altamont Enterprise, Nov. 13, 2025]. And I think having all that at the same time probably was a good thing, all shared in the same paper.”

The experience, though, has left Altamont with a “trust deficit,” Dineen said.

She said she watched the online video of the budget hearing and described the segment on Altamont’s tax hike as “pretty quick.”

Dineen said of the town board members at the Nov. 6 hearing, “No one said a word. There wasn’t a discussion. There wasn’t anything shared at all, which that’s where the trust part comes in because I would have expected to hear something.”

Council Jacob Crawford interjected that the board had “exhaustive conversation” during its budget workshops. “We did throw different ideas out,” he said. “We asked a number of different proposals; could we do it this way?”

While Dineen conceded that budget workshops are not well attended, she said, “Budgets are supposed to be public.”

Dineen went on to make two recommendations going forward.

She asked that Guilderland’s “financial folks” come to the December village board meeting for a workshop “so we can ask and answer questions.”

She told the board, “That might be something where people can hear it from you because it’s not my numbers to explain. They’re not my information.”

She also said, “We’ll have it recorded and people will understand it better.”

The meeting she requested has been scheduled for Dec. 3 at 6:30 p.m. at Altamont’s village hall at 115 Main St.

Second, Dineen said, “I still think there are amendments that can happen to lessen the impact.”

“I don’t want to have any trust issues with the town,” said Dineen. “We are on the same team. You guys are our leaders …. I just think this is unfortunate this happened and I don’t think this increase should stand.”

Dineen concluded, “There’s going to be a fallout down the road if something isn’t changed how it’s calculated. And I don’t mean not doing what the comptroller is saying, but working within those parameters.”

Barber responded, “I think the problem is literally, when you are told to keep this thing confidential, on one hand, and you have to have a public hearing on this, how do you reconcile the two? And they literally said, ‘That’s your problem.’”

Village Trustee John Scally said, as Dineen had, that he appreciated the explanation for the tax increase.

“Reading the news article myself with my family,” he said, “we were a bit shocked ourselves.”

He suggested there could be a conversation between leaders of adjoining municipalities so “this doesn’t happen in the future.”