Town taxes to jump 162% for Altamont residents

GUILDERLAND — On Thursday, the Guilderland Town Board unanimously adopted a $47.7 million budget for next year that will decrease the average property tax bill in town by $16 but will increase the tax bill for Altamont village residents by about $240.

“I think it’s unfair,” said Supervisor Peter Barber in announcing the 162-percent increase for village residents at a public hearing on the budget.

Following a state audit, Barber said, Guilderland has to comply with the comptroller’s recommendations on how the town uses the sales-tax revenues it receives through Albany County. That money is allocated to municipalities across the county based on population.

The town’s budget, Barber explained, has multiple funds, including an all-town A Fund that includes the village, a B Fund that does not include Altamont, and a DB Fund for highway work that includes “certain activities that occur outside the village.”

Barber went on, “The reason why we have A and B funds is because the village has its own government, has its own taxes; it has its own mayor, parks, police, and other departments. So again, the idea is we’re not going to overlap in providing services.”

[See related letter from the Guilderland town board]

Referring to sales-tax revenues coming in through the county, Barber said, “We get a lot more than the village does, because it’s based upon population. And so we use that sales tax to basically eliminate any property tax in the part-town B Fund. Again, that’s outside the village.”

For years, Barber said, the town has used a “substantial margin of sales tax to reduce the property taxes in the A Fund, which includes the village.”

However, the comptroller’s office, he said, determined, “You can’t do it the way we’re doing it.”

The comptroller’s office says the town must use its sales-tax revenues to first eliminate real property taxes in the DB Highway Fund before it can use sales tax to reduce real property taxes in the A Fund.

Although Barber disagrees, he says the town has to comply.

Barber believes that the state’s tax law requires Guilderland “to reduce” and not eliminate taxes in the DB Highway Fund, and also allows Guilderland “discretion” to use the sales tax balance to reduce real property taxes in the A Fund as it has for years.

Barber told The Enterprise on Friday that the section of the state tax law passed in 1965 is “antiquated,” noting, for example, that in that era ambulance crews were volunteers but now make up a large budget expense.

“This is tying the town board’s hands,” he said of the comptroller’s interpretation.

Asked what services the town provides for the village of Altamont, Barber named highway work, police back-up, helping with transportation for seniors, and assistance with information technology.

“We treat village residents as town residents,” Barber said, noting that the village also works cooperatively with the town.

Barber concluded at Thursday’s hearing, “So what it means, again, is that village residents get hit this year with an increase. The rest of the town, which is about 96.5 percent of the real property of the town, is going to see a very small decrease in their tax bill because, again, we’re shifting property tax away and relying more on sales tax.

“So, again, it’s not a change in how we’re spending. We’re still pretty prudent, careful with our taxpayer dollars. It’s simply just that we have to adhere to what the state comptroller wants us to do.”

Overview

No members of the public spoke at Thursday’s budget hearing and the town board had no discussion before the unanimous vote for adoption.

Barber commended Town Comptroller Darci Efaw and Budget Officer Jessica Gulliksen on their work on the budget.

Barber noted that Guilderland has always stayed under the state-set levy limit since its inception in 2012. This year’s levy represents an increase of 2.68 percent.

He also pointed out that town taxes make up just 11 percent of property owners’ tax bills; school taxes account for 68 percent, county taxes for 12 percent, fire-district taxes for 5 percent, and library taxes for 4 percent.

Most of Guilderland’s revenue comes from sales tax — $16.9 million for 2026, up 2 percent from this year — followed by property tax: $14.4 million, up 2.8 percent.

“Inflation, unfortunately, generates more sales tax,” said Barber, “but also discourages people from buying, so it’s kind of a mixed bag.”

Sales-tax revenues remain robust statewide. Local government sales tax collections totaled $18.2 billion from January to September 2025, an increase of 4.3 percent compared to the same period last year, according to the quarterly sales tax report released on Oct. 30 by State Comptroller Thomas DiNapoli.

“New York’s local sales tax revenues rose through September compared to last year, but federal policy actions create significant fiscal risk for municipalities amid signs of a slowing economy,” DiNapoli said in a statement, releasing the report.

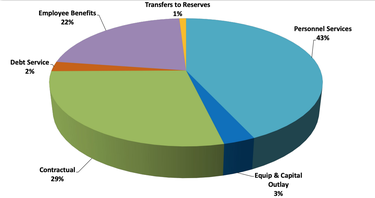

On spending, Barber said, “We are a people business. We have a lot of employees, so we have personal services at 42 percent and employee benefits at 22 percent” of expenditures.

He noted, “Health-care costs and retirement costs are continuing to go up.”

New York state retirement costs went up 19 percent, an increase of $580,000, totaling $3.6 million. Health-insurance costs went up 11 percent, an increase of $467, 000, totaling $4.7 million.

“We’re also providing 3-percent salary adjustments across the board,” said Barber while total employment is unchanged.

He went over a list of capital additions, including two more police cars; an ambulance; a used bus to transport seniors; two trucks and a mower as well as a new camera security system for the highway department; a used dump truck, sprayers, and a shop lift; and a body shop.

Mentioning a federal grant Guilderland received last year to replace police cars, Barber said, “The federal government is not a trusted partner these days, so I’m not going to rely on them.”

Barber also went over anticipated budget additions, to be funded largely through grants.

This includes a sidewalk on Carman Road from Western Avenue to East Old State Rd, a sidewalk on East Old State Road from Carman Road to Hillside Road, and a multi-use trail on Route 146 from Western Avenue to Winter Recreation Area.

Anticipated park improvements include playgrounds at DiCaprio, Fort Hunter, Nott Road, and Volunteer Firefighters parks; dedication of the Kaikout Kill Park, with a planned multi-use path to YMCA Guilderland Public Library; sun shades at the Tawasentha Park pool; pickleball courts at Nott Road; and lighting for the girls’ softball field at Keenholts Park.

Barber said of the new lighting, “I think our goal here is to try to treat with parity girls’ softball with boys’ baseball, to make sure we get a premier field, something that the girls’ softball leagues are greatly appreciative of.”

Guilderland has close to $20 million in its various fund balances as well as $13.6 million in its various reserves.

Barber noted that the reserve for a property revaluation update is about $273,000 and said he regularly checks with the town’s assessor to see if “we are anywhere close to a reassessment.”

“Probably not this year, not next year, but she’s not going to promise beyond that … That is really based upon the economy and what’s happening out there in the market,” said Barber.

Before the most recent 2019 revaluation, the last time the town had completed a full town-wide revaluation was in 2005.

“We did it last time primarily because apartments were grossly undervalued and that was putting a financial burden on single-family homes,” said Barber, adding that the 2019 revaluation shifted the tax burden away from single-family homes.

“Right now,” Barber went on, “it’s somewhat chaotic but you actually want to wait for things to stabilize. You don’t want to do a reval while prices are constantly changing because then you might miss the value or you might unintentionally penalize one or more groups.”

Barber concluded that the town is facing “continuing inflation impacts” and said, “Economic conditions with all the tariffs out there are just unpredictable. So it’s best to be very careful and cautious and prudent …. We’re going to start the year with a healthy fund balance and growing reserves.”