GCSD expects 23% increase in state aid next year, 3% levy increase

GUILDERLAND — Based on the governor’s budget proposal, the school district here is expecting a nearly 23-percent increase in state aid next year — to total $37.5 million of what is expected to be a $118 million budget, up from $110 million in spending this year.

The jump in aid is largely because Guilderland’s Foundation Aid, if the legislature goes along with Kathy Hochul’s plan, would increase from about $19 million this year and last year to $24 million next year, according to Andrew Van Alstyne, Guilderland’s assistant superintendent for business.

In a Feb. 14 presentation to the school board, Van Alstyne explained, “The idea of Fondation Aid is the state determines how much it costs to educate a student, how much of that money a district has the capacity to provide locally, and then how much additional costs there are for certain kinds of students — like students with disabilities, students in poverty, English language learners, and, you know, allocates additional money for those students.”

He displayed a chart, showing Foundation Aid statewide hovering between $13 billion and $15 billion since 2007 before making a jump starting two years ago as part of a three-year phase-in, growing to $19.1 billion next year.

Van Alstyne said, rather than considering next year “a really, really high mark,” it could be seen that the earlier years were all underfunded. But he called that a “thought exercise” since he conceded it “is very unlikely the state is going to look at it that way and say, ‘Here, let us give you all the money that we should have given you in the past.’”

Aid in other categories — such as transportation, building, BOCES, hardware and technology, and software and library — is also slated to increase for Guilderland next year.

Noting Hochul’s mission to restore Foundation Aid, Van Alstyne said, “Next year would be the first year that every school distinct in the state receives its full foundation aid. This is a historic achievement. It’s very noteworthy, and it’s worth celebrating.”

However, Van Alstyne called it “slightly troubling” that Hochul is carving out some of the Foundation Aid — meant for school district’s to achieve their own goals, he said — requiring it to be spent on “high impact tutoring.”

Guilderland is to spend $520,181 for “new efforts for high impact tutoring for students,” he said.

Pre-kindergarten

Hochul’s plan also expands funding for universal pre-kindergarten, which Van Alstyne explained is allocated only if a district fills the slots for 3- and 4-year-olds.

The governor’s plan allocates $1.5 million for Guilderland’s pre-kindergarten program, up from $626,400 this year and about $1 million the year before.

The district had been caught by surprise when the state money was first allocated and scrambled to find local preschools that could teach the pre-K students.

Guilderland won’t be able to spend the pre-K funds it was allocated this year. “They awarded us more than 90 additional slots of funding,” said Van Alstyne. “This is not something that we are likely to be able to have the space or the partnerships to be able to realize.”

“We do not have any space within our schools in order to offer 4-year-old pre-K,” said Superintendent Marie Wiles. Although, within the last decade, the district had considered closing one of its five elementary schools before temporarily leasing rooms to a child-care provider, Wiles went on, “All of our elementary buildings are essentially full capacity.”

So, when the state first provided Guilderland with pre-K funding, Wiles said, “the only option we had was to reach out to community partners to offer the program.”

The district put out a request for proposals and the first year, two schools responded, providing about 40 slots, Wiles said, “which was for less than the full funding.”

The second year, four schools responded so about 110 slots were provided.

“We seem to be maxed out at that,” Wiles said, “because those entities don’t have more capacity either.” It is a function of both lack of space and lack of staff, she said, “so unless there are new providers that arrive in Guilderland, we’re kind of maxed out at that number.”

However, Wiles also said that “some creative conversations are happening regionally” because many of the suburban schools are in the same dilemma.

“None of us are able to fully utilize the additional resources,” Wiles said, so there is talk of looking for a space — perhaps “Catholic schools that are no longer functioning” — that could be used for a regional pre-K program. The idea, though, is “in its infancy,” said Wiles, and at least another year out.

Currently, a lottery system is used to fill the available pre-K slots.

“Sometimes,” said Wiles, “the children whose parents have the least means to pay for pre-K don’t get selected in the lottery, and other families who would have sent their children regardless, do get in.”

So school leaders are talking to elected officials about changing to a system that would “give preference to those who are struggling economically,” Wiles said, concluding, “We have not gotten progress there yet.”

Tax levy

Local property taxes pay for the majority of Guilderland’s budget each year.

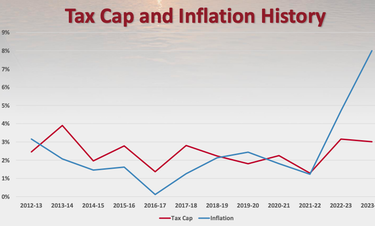

For the last decade the state has set a levy limit, which Van Alstyne described as “a quasi-complicated formula that boils down to most expenses fall inside of regular operations; those are subject to the 2-percent, or in inflation, whichever is lower, cap.”

If a district’s budget is below the cap, a simple majority is needed to pass a school budget. If the spending plan is over the cap, a supermajority — more than 60 percent of voters — is needed to pass a budget.

If a school budget is voted down, the same budget or a modified budget can be put up for vote. A second budget defeat means a district has to adopt a contingent budget and not raise taxes at all.

Van Alstyne explained the levy-limit calculations for next year, which include a modest increase in property values, and concluded the maximum allowable tax levy is $80.6 million, a 3.01-percent increase from this year’s levy of $78.2 million.

He stressed that the 3.01-percent cap was “a preliminary calculation” and that “some pieces of this data can change.”

Van Alstyne displayed a chart showing how, until now, the tax cap and inflation rates were “fairly similar to each other” — then, “all of a sudden, inflation jumps to 8 percent.”

He went on, “Inflation hit us in a couple of ways.”

The lion’s share of the budget, typical of all schools, is for salaries and benefits, determined by contracts, which will be affected by inflation, Van Alstyne said.

Also, ongoing capital projects and transportation costs “are very vulnerable to inflation,” he said.

Wiles said she would soon be sharing two lists with school board members — one of requests from across the district on the best use of the remaining federal COVID-related funds and the other of requests “that could potentially be concerned for the general operating budget.”