Albany County maintains AA rating from S&P

ALBANY COUNTY — As Albany County is in the midst of restarting its economy, it is bracing for the losses caused by a three-month shutdown to stem the spread of the coronavirus.

Albany County has a $730 million budget, about 40 percent of which — the single largest source — comes from sales-tax revenues. About 11 percent of the county’s revenues come from the federal government, about 13 percent comes from the state, another 13 percent comes from property taxes, and the rest from miscellaneous sources.

The county also has about $60 million in reserves, which Albany County Executive Daniel McCoy termed an “historic high.”

“With 75,000 out of work in the Capital Region alone, people’s reserves are going down,” said McCoy on Friday.

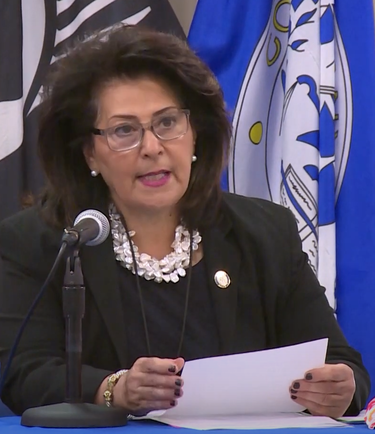

The county’s comptroller, Susan Rizzo, announced at Friday’s county press briefing that, as part of a recent refinancing, Standard & Poor’s has assessed Albany County’s credit worthiness, and reaffirmed its rating of AA “with a stable outlook while other municipalities were downgraded due to the pandemic,” she said.

Standard & Poor’s assigns bond credit ratings of AAA, AA, A, BBB, BB, B, CCC, CC, C, D. A rating of AAA means an obligor has extremely strong capacity to meet its financial commitments while a rating of D means an obligor has failed to pay one or more of its financial obligations when it became due.

Albany County’s rating of AA means it has very strong capacity to meet its financial commitments.

“Why is this important?” Rizzo asked of maintaining the AA rating. She answered herself, “The higher the rating, the lower the interest rate.”

Rizzo, who was elected in November and became comptroller on Jan. 1, continued, “Keeping our credit rates is a testament to the financial stability of Albany County as well as a result of the reorganization of the comptroller’s staff, including the addition of people with vast financial experience.”

Rizzo said that last week her office completed a refinancing of $7.2 million of the county’s outstanding debt, issued in 2012. She said the refinancing will save taxpayers over $1 million.

“We reduced the interest rate to .59 percent as compared to the original rate of 2.3 percent,” she said.

“Additionally, we completed new borrowing totaling $4.1 million for essential capital projects with a net interest rate of 1.74 percent,” Rizzo said. These projects, she said, include equipment for the county’s nursing home; the construction and repair of county roads; and improvements to the sheriff’s public-safety building, the former Clarksville school.

McCoy said a lot of capital projects were cancelled because of the pandemic.

Also, Rizzo said, her office has been working with the county’s Department of Management and Budget to address capital projects that were never closed. “We plan to transfer several million dollars to the debt reserve and use the funds to pay principal and interest on the county’s current debt,” she said. “Unfortunately, per IRS rules and regulations, past borrowings that were identified for very specific projects cannot be used for new projects going forward.”

Rizzo concluded by asking, “What does this mean in today’s pandemic? A lot. The county is projecting a deficit. By correcting the county’s books and records, we can free up some cash to help with this deficit.”

Rizzo said several audits are underway and concluded, “In these turbulent times, closely monitoring our financials in an efficient process is imperative.”

Local leaders “nervous”

Shawn Thelen, commissioner of the county’s Department of Management and Budget, said of sales-tax revenues in Albany County, “For the first quarter, we were roughly a point or two down for year-over-year, which wasn’t that bad as the epidemic just had started by the time the first quarter was about to close”

Thelen said he won’t have a handle on the sales-tax revenues from the second quarter — April, May, and June — until the first week of July.

Statewide, according to Comptroller Thomas DeNapoli, sales-tax revenue for local governments in May fell 32.3 percent compared to the same period last year. Sales tax collections for counties and cities in May totaled $918 million, or $437 million less than 2019.

Thelen said of the sales-tax revenues that typically fund 40 percent of Albany County’s budget, “It’s by far the largest revenue source — roughly $280-, $290-million — which $180-, $190-million of that stays with us in Albany County but the other $100 million goes to our municipalities within the county. So the towns and villages feel the effect when you have a sales-tax turnaround like that.”

Thelen noted that, for every dollar the county gets from property taxes, it gets two dollars from sales tax. “So, when that number falls short, that burden, we have to think of some ways to minimize that so that the taxpayer doesn’t feel it as much.”

Thelan noted that, at the same time the county is losing revenues, it has to “still provide the services that we’re mandated to and that the people in the community need.”

McCoy said, “I’ve talked to a couple of supervisors in the Hilltowns; I’ve talked to mayors and supervisors — they’re all nervous because it’s going to be a difficult budget process.”

McCoy also said that much will depend on how much money in the fifth federal coronavirus stimulus package goes to county governments, which have not only lost revenues but have had many added expenses tracking and stemming the spread of the coronavirus.

“We’ve got to continue to run programs; we’ve got to continue to help the vulnerable populations,” McCoy concluded.