Week CXXXIII: After a pandemic dip, New Yorkers’ household debts surge

ALBANY COUNTY — With the arrival of fall this week, COVID rates are inching up as are hospitalizations.

But no new COVID-related deaths were reported this week for Albany County. The death toll, according to the county’s dashboard, remains at 582 residents.

Albany County, for the 13th week running, continues to be labeled by the Centers for Disease Control and Prevention as having a “medium” community level of the virus.

While most of the counties in the nation — about 62 percent — are labeled “low,” most of the counties in New York State, along with 31 percent nationwide, are labeled “medium.”

In New York State, five counties — Oswego, Fulton, Montgomery, Putnam, and Suffolk — are labeled “high” as are 7 percent of counties nationwide.

“As we welcome the fall, I urge New Yorkers to remain vigilant, be sure to use the tools that are available to keep themselves, their loved ones, and their communities safe and healthy,” Governor Kathy Hochul said in Tuesday’s press release from her office. “Take advantage of the vaccine by staying up to date on doses. Test before gatherings or travel and if you test positive, talk to your doctor about potential treatment options.”

This is similar to advice dispensed by World Health Organization Director-General Tedros Adhanom Ghebreyesus, an Ethiopian public-health researcher, during a recent press conference.

“Last week, the number of weekly reported deaths from COVID-19 was the lowest since March 2020,” he said. “We have never been in a better position to end the pandemic. We are not there yet but the end is in sight.”

Just as Albany County’s executive repeatedly did in his daily 2020 pandemic press conferences, Ghebreyesus likened it to a marathon.

“A marathon runner does not stop when the finish line comes into view,” he said. “She runs harder, with all the energy she has left. So must we. …. If we don’t take this opportunity now, we run the risk of more variants, more deaths, more disruption and more uncertainty.”

WHO released six policy briefs outlining the key actions governments must take based on the evidence and experience of the last 32 months of what works best to save lives, protect health systems, and avoid social and economic disruption, Ghebreyesus said.

“We urge all countries to invest in vaccinating 100 percent of the most at-risk groups, including health workers and older people as the highest priority on the road to 70-percent vaccine coverage,” he said.

In Albany County, as of Tuesday, 61.7 percent of eligible residents had received booster shots, according to the state’s dashboard, while 75.3 percent had completed a vaccination series. This compares with 78.8 percent of New Yorkers statewide completing a vaccination series.

Ghebreyesus went on, delineating the six key actions: “Keep testing and sequencing for SARS-CoV-2, and integrate surveillance and testing services with those for other respiratory diseases, including influenza.

“Make sure you have a system in place for giving patients the care that is right for them and integrate care for COVID-19 into primary healthcare systems. Plan for surges of cases and make sure you have the supplies, equipment, and health workers you will need. Maintain infection prevention and control precautions to protect health workers and non-COVID patients in health facilities.

“Communicate clearly with communities about any changes you make to your COVID-19 policies, and why. And train health workers to identify and address misinformation, and develop high-quality health information in a digital format.”

Except for China, which still has a zero-COVID policy with massive lockdowns and quarantine camps, most of the world has adopted a live-with-COVID approach while taking recommended precautions.

For New Yorkers, that means getting bivalent COVID-19 vaccine boosters from Pfizer-BioNTech for anyone age 12 or older and from Moderna for those 18 or older. To schedule an appointment for a booster, New Yorkers are to contact their local pharmacy, county health department, or healthcare provider; visit vaccines.gov; text their ZIP code to 438829, or call 1-800-232-0233 to find nearby locations.

The state’s health department is also urging New Yorkers to get their annual flu vaccine as flu season approaches. The flu vaccine is recommended for almost everyone 6 months and older.

Although figures on infection rates are no longer reliable since tracing and tracking systems have been disbanded, the state dashboard shows that cases statewide and in Albany County have continued to rise for the last month or more.

Albany County, as a seven-day average, now has 19.7 cases per 100,000 of population, up from 17.1 last week, 16.3 two weeks ago, 17.0 three weeks ago, 17.3 four weeks ago, 17.9 five weeks ago, and from 19.3 six weeks ago, but down from 21.8 cases per 100,000 seven weeks ago.

This compares with 23.4 cases statewide, which is up from 22.2 cases last week, 18.6 cases two weeks ago, and 21.09 cases three weeks ago, but down from 23.0 four weeks ago, 25.6 five weeks ago, and 30.03 per 100,000 of population six weeks ago.

The lowest rate is still in the Finger Lakes at 17.44, which is up from 14.29 last week, 12.81 two weeks ago, 11.40 three weeks ago, 12.42 four weeks ago, 12.09 five weeks ago, 12.65 six weeks ago, and 12.92 seven weeks ago.

The highest count is now in Central New York at 30.19 cases per 100,000 of population, displacing Long Island as having the highest seven-day average. Long Island is now at 28.55 cases per 100,000, a slight decrease from last week’s 28.72.

As of Sept. 26, according to Albany County’s COVID dashboard, the seven-day average for hospitalized COVID patients was 27.29, slightly higher than last week’s average of 23.57, and a marked increase from two weeks ago when the county’s seven-day average for hospitalized residents was 15.14.

Household debt soars

Also this week, the state’s comptroller, Thomas DiNapoli, released an analysis showing that, while New Yorkers’ household debt dipped in 2020 when the pandemic started, it has since soared.

“High levels of pre-pandemic debt declined during the early part of the pandemic when an economic shutdown prompted lower spending and stimulus payments allowed consumers to pay down debt balances,” DiNapoli writes in the report. “In 2021, however, as pandemic relief efforts wound down and states relaxed distancing restrictions, consumer spending and credit card balances began to rise again, a trend continuing in 2022.”

Even before the current inflation surge and before the pandemic, the report notes, data from a 2018 survey conducted by the Financial Industry Regulatory Authority found that 28 percent of people in New York State with credit cards made only the minimum monthly payment; 41 percent of New Yorkers did not have a rainy-day fund to cover expenses in case of emergency; and 12 percent of homeowners owed more on their home than its current market value.

DiNapoli’s report found that average household debt in New York climbed to a new high of $53,830 in 2021 with student-loan and credit-card debt well above the national average.

Debt has increased 4 percent nationally and 2 percent in New York in the first two quarters of 2022 and is now the highest on record, exceeding previous highs from 2008, the report says.

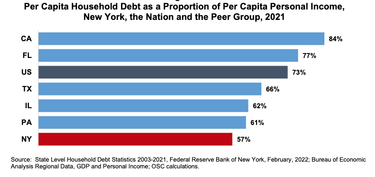

New York fares better than the nation and peer states (California, Florida, Texas, Illinois, and Pennsylvania) on per-capita consumer debt in relation to the average personal income level in the state. On that measure, New Yorkers have a debt ratio of 57 percent compared to 73 percent for the United States as a whole.

Per-capita debt in New York differs from the national profile: mortgages and auto-loan debt are lower in New York, while credit-card and student-loan debt are higher on average.

New York’s per-capita credit card debt was $3,520 in 2021, seventh in the nation, and credit-card balances were a larger share of per-capita household debt in New York, at 7 percent, than nationally, at 5.5 percent. Credit-card debt typically has substantially higher interest rates than other types of household debt and can be indicative of financial stress when used for routine expenses, the report notes.

New York’s per-capita student loan balance was $6,180 in 2021, which is 11th in the nation, representing growth of 335 percent from 2003. The high growth rate, however, was less than the national average of 432 percent and less than peer states, at 448 percent. DiNapoli said President Joe Biden’s new student loan forgiveness program should help New Yorkers struggling with student loan debt.

New York’s delinquency rate of 2.1 percent for consumer debt also exceeds the national average of 1.9 percent, but is lower than it was before the pandemic, at 3.8 percent. Credit-card debt had the highest share of delinquent accounts at 8.9 percent in 2021. The delinquency rate of 0.9 percent for mortgage loans is highest in the peer group and nearly double the 0.5-percent national rate.

“Pandemic relief programs, including moratoriums on mortgage and student loan payments as well as stimulus payments, and lower interest rates in 2020 allowed for a small reduction in per capita household debt in New York in 2020,” the report concludes. “Nevertheless, by the end of 2021, total consumer debt in the United States and in New York had reached record levels of $15.6 trillion and $869.4 billion, respectively, and continues to grow in the first two quarters of 2022.”

The report also notes, “While the most significant share of New York household debt is for mortgages, through which households can increase asset wealth, mortgage delinquencies are relatively high in New York, even as they have declined significantly from double-digit rates in 2010 and 2011.”

The report stresses the need for financial-literacy education, citing DiNapoli’s 2019 executive order for such.

The website for his office includes resources for personal financial literacy and navigating financial hardships caused by the COVID-19 crisis: https://www.osc.state.ny.us/financialempowerment-resources.

In addition, New Yorkers who are facing difficulties with managing debt or who want to better educate themselves on issues of debt can refer to the resources from the Federal Trade Commission: https://consumer.ftc.gov/credit-loans-and-debt/credit-and-debt.

The Consumer Financial Protection Bureau also offers information intended to better inform household financial decisions at https://www.consumerfinance.gov/consumer-tools.

Workers’ comp

The Workers’ Compensation Board is continuing its webinar series for workers who believe they contracted COVID-19 on the job, especially those who have missed time from work or are suffering from ongoing or “long-haul” symptoms.

Each one-hour session will provide information on workers’ rights when it comes to filing a workers’ compensation claim and the cash and/or medical benefits they may be eligible to receive.

While the online sessions are targeted toward workers who have lost time from work, have ongoing medical problems, and/or fall into the category of “long haulers,” the information is relevant to anyone who believes they may have contracted COVID-19 due to an exposure at work.

Workers have two years from the time they contracted COVID-19 to file a claim.

Registration is not required to attend a webinar. The next one runs from noon to 1 p.m. on Wednesday, Oct. 12.

More information on COVID-19 is on the board’s website, including information on how to file a COVID-19 workers’ compensation claim and a link to search for a board-authorized health care provider.