State COVID testing up, tax revenues down

ALBANY COUNTY — As the governor announced the highest number of test results in any day — 98,880 — Albany County on Friday reported eight new cases of COVID-19.

Of those new cases, one was of a healthcare worker or resident of private congregate settings, three had close contact to someone with COVID-19 and four did not have a clear source of transmission detected at this time.

Governor Andrew Cuomo also announced that hospitalizations in New York State dropped below 500 for the first time, to 490, the lowest number since March 16. The number of ICU patients dropped to 119, the lowest number since March 15.

Seven Albany County residents remain hospitalized with none in an intensive care unit; the county’s hospitalization rate remains at 0.28 percent, according to a release from the Albany County Executive's Office.

The county’s death toll from COVI-19 remains at 131.

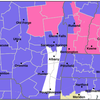

Statewide, the rate of positive tests — 0.72 percent — was below 1 percent for the 14th straight day. For the Capital Region, of which Albany County is a part, the percentage of positive tests for the last three days is 0.7 percent. The lowest percentage in the state’s 10 regions is, as usual, the North Country — at 0.2 percent. The highest is Western New York at 1.6 percent.

Albany County now has 2,450 confirmed cases of COVID-19 with 626 residents under quarantine.

The five-day average for new daily positives has ticked up to 7 from 6.2 on Thursday. There are now 27 active cases, decreasing from 28 a day ago

So far, 8,876 county residents have completed quarantine. Of those who completed quarantine, 2,423 of them had tested positive and recovered, an increase of 9.

State tax receipts down 10 percent

New York State Comptroller Thomas DiNapoli released a report that showed state tax receipts through the first four months of the fiscal year — $26.4 billion — were $3 billion less or 10.2-percent below the same period last year.

“The shift of the tax filing deadline from April to July this year added to the revenue uncertainty created by the COVID-19 pandemic,” DiNapoli said in a statement, releasing the report. “July numbers show more clearly the extent of the revenue damage from the pandemic, which is driving both unanticipated spending and declining tax receipts.”

He went on, “Washington’s continued delay on further federal response leaves the state, local governments, nonprofits and others with increasingly difficult questions on how to maintain the services New Yorkers need during this national emergency.”

The report shows that personal income tax collections totaled $18.9 billion through July, which is $1.4 billion, or 6.8 percent, lower than a year ago. Receipts from personal income tax withholding were 1 percent, or $133.1 million, below the previous year, while estimated payments were 14.4 percent, or more than $1.3 billion, lower.

Sales tax receipts of $4 billion for the first four months were down $1.2 billion from a year earlier, a drop of 23.1 percent. The year-over-year decline in July, 8.6 percent, was the lowest since March.

All funds spending through July totaled $53 billion, down $2.3 billion, or 4.2 percent, from the previous year, including a $1.8 billion decline in local assistance grants.