In NYS, 4 of 5 small businesses still feel negative impact from pandemic

ALBANY COUNTY — Small businesses across New York State continue to suffer from the pandemic more than those nationwide, according to the state’s comptroller, Thomas DiNapoli.

During the first week of March, 72 percent of small businesses — defined as those with 500 employees or fewer — nationwide reported an overall negative impact, according to an analysis based on a survey by the United States Census Bureau.

The comparable figure for New York State was 78 percent — or nearly four out of five businesses.

Both nationwide and statewide, the percentages of small business reporting a negative impact has declined from a year ago, although the decline in reported negative impact has been less swift in New York than nationwide.

Nationwide, the share has declined from 90 percent in April 2020 when data were first reported; in New York, 98 percent of small businesses initially reported a negative impact.

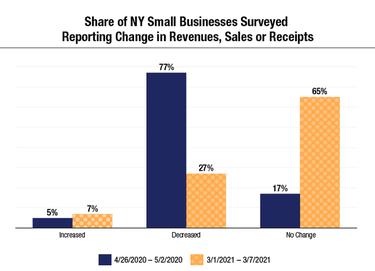

Most small businesses — in New York State and nationwide — saw a quick decline in revenues when the pandemic hit a year ago. Seventy-seven percent of New York’s small businesses reported a decrease in revenues, sales, or receipts, not including financial assistance or loans, at the end of April 2020, according to the U.S. Census Bureau.

While few small businesses report that revenues are growing, most are no longer seeing declines: only 27 percent reported declines in the first week of March while 65 percent reported no change.

Two federal programs offer financial help for small businesses: the Paycheck Protection Program and the COVID-19 Economic Injury Disaster Loans.

Economic Injury Disaster Loans are available for a 30-year term with payments deferred for one year.

The Paycheck Protection Program provides small businesses loans for payroll and other qualified expenses. The loans can be forgiven if the businesses retain employment levels and meet other conditions, essentially turning the loan into a grant.

As of March 7, 2021, New York State businesses received 508,650 loans totaling $51.9 billion.

The American Rescue Plan signed by President Joe Biden last week authorized several new and continuing programs for small businesses, including expansion of the Paycheck Protection Program to small not-for-profits, a new relief fund for restaurants, and funding for cultural institutions and performing arts venues.

A new $10 billion Small Business Opportunity Fund would also target funding to states with higher unemployment for state programs to provide loans or assist with small business credit access. As New York’s unemployment rate remains the fourth highest in the nation, it will likely benefit a great deal from this fund, the state comptroller’s office said.

Newest numbers

As of Saturday morning, Albany County has had 21,634 confirmed cases of COVID-19, including 64 new cases, according to a release from Albany County Executive Daniel McCoy.

Of the new cases, 41 did not have clear sources of infection identified, 20 had close contact with someone infected with the disease, two were health-care workers or residents of congregate settings, and one reported traveling out of state.

The five-day average for new daily positives has increased to 62.4 from 61. There are now 483 active cases in the county, up from 454 on Friday.

The number of county residents under quarantine decreased to 1,204 from 1,353. So far, 68,657 residents have completed quarantine. Of those, 21,151 had tested positive and recovered. That is an increase of 33 recoveries since Friday.

There were four new hospitalizations overnight, and there are now 27 county residents hospitalized from the virus. There are currently four patients in intensive-care units, down from five yesterday.

Albany County’s COVID-19 death toll remains at 365.

Statewide, the infection rate, as of Friday, as a seven-day rolling average, as 3.3 percent.

For Albany County, also as of Friday, as a seven-day rolling average, the infection rate was 1.8 percent, according to the state’s dashboard.