Next year’s $34.5M VCSD budget essentially flat

NEW SCOTLAND — The Voorheesville School Board recently voted to place before residents on May 20 a $34.5 million budget for the 2025-26 school year.

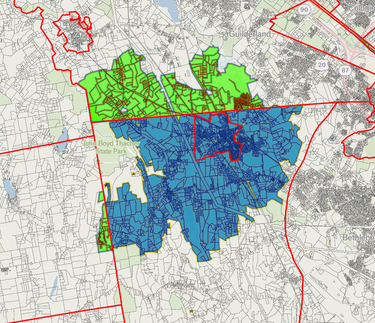

If approved, next year’s budget would represent a 0.15-percent increase over this year and a nearly 6-percent increase in the property tax levy; the district is still working on what that means for individual residents’ tax bills in the three municipalities that make up the district, who, after the application of the equalization rate, currently pay school taxes of about $15 per $1,000 of assessed value.

The tax levy is at the state-set limit for next year, $22,253,153.

The district is using approximately $781,000 in fund balance to fill the gap in next year’s budget. It’s losing two teacher-assistant positions through attrition and adding a social worker at four-tenths time.

For the next two decades, the levy has an annual 2.5-percent increase built in because the district has to pay off the bond of its $25 million capital project.

“I’d like to tell the board that this has not been a very easy budget to develop,” the district’s interim business official, Lissa Jilek, previously told the school board. “And the reason why is the whole capital project and the debt service and the planning as to when are the taxpayers actually going to incur that debt and how much are they going to incur. There’s been an awful lot of conversations about that. So this has not been like an easy rollover budget.”

The budget increase for next year appears nominal in part because this year’s spending plan included a one-time $3 million capital project layout. Absent that one-time payment, next year’s budget is up about 9.7 percent from this year, as categorical numbers from the district spending shows:

— General support: $4,113,736, up $390,022, or 10.47 percent;

— Instruction $16,870,990, up $517,255, or 3.16 percent;

— Pupil Transportation: $1,599,736, up $213,835, or 15.43 percent;

— Community Services: $77,349 $77,349, or zero percent;

— Employee Benefits: $9,785,071, up $891,664, or 10.03 percent;

— Debt Service: $1,915,839, up $1,037,579, or 118.14 percent (beginning to pay down bond); and

— Total Expenditures: $34,532,721, up $50,355, or 0.15 percent.