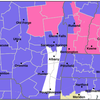

Albany County Legislature raises hotel tax along party-line split

ALBANY COUNTY — Facing unanimous opposition from its minority GOP branch, the Albany County Legislature passed a hotel occupancy tax increase of 0.5 percent that will be in effect from 2025 until at least the end of 2027.

The increase will bring the rate up to 6.5 percent, which GOP lawmakers argued will drive down tourism in the county, despite the tax revenue going toward local tourism initiatives.

The law allocates the funds this way:

— Two-thirds of the revenue will go to the county’s Civic Center Debt Service Fund, which encompasses all civic center expenses;

— Another one-sixth will go to the newly created Albany Convention Center Authority Fund, which will be used by the authority of the same name for a future convention center project; and

— The final sixth of the revenue will be used to cover the expense of administration of the tax and to promote tourism in the county more generally, in partnership with the Albany County Convention and Visitors Bureau.

The increase is expected to raise an additional $800,000 per year.

Chairwoman Joanne Cunningham, the bill’s sponsor, told The Enterprise in a statement that it is “a nominal increase in the County’s hotel tax which will go a long way in supporting economic development throughout Albany County.”

Minority Chairman Frank Mauriello said this in a statement: “Months ago, our Conference proposed an alternative solution to fund economic development at a higher rate without raising taxes. The bill was rejected by the Legislative Majority for some inexplicable reason, and now visitors coming to our County will have to think twice about staying in one of our hotels thanks to these added costs.”

Republican Mark Grimm, ranking member of the legislature’s finance committee, wrote in a statement that, with the county wealthy enough to now have cut property taxes 11 times in a row after the unanimous passage of the 2025 budget earlier this month, it should not be taking “extra money” out of tourists’ pockets.

The money, he said, could instead be spent at local businesses in the county.

“Is one of the real problems in Albany County that we don’t tax people enough?” Grimm asked at the Dec. 16 legislature meeting.

Republican legislator Todd Drake said that, while he believes the county needs more money given its new cost burdens, such as the St. Rose campus, the manner in which it’s raising the money creates “hurdles” for small businesses and goes against economic development.

“Regardless of my support for the Advance Albany County Alliance,” he said, referring to the local economic development organization, “I have to vote no on additional taxes.”

As The Enterprise reported in October, Albany County was among the top counties in the nation for its growth in new business applications last year, rising by around 33 percent, according to the United States Census Bureau. That metric does not, however, capture the number of actual new businesses.