Equalization rates to blame in county tax confusion

ALBANY COUNTY — Despite a county budget that drew bipartisan praise for a lower property tax rate this year, many property owners in Albany County upon receiving their tax bills found out that the amount they owe has gone up.

For that, blame local growth.

County spokeswoman Mary Rozak told The Enterprise that, although the county’s tax levy has stayed the same three years in a row — while the total taxable full-market value in the county has gone up, resulting in a lower rate overall — the rate on individual tax bills comes down to those local factors.

“The taxable value total [in a municipality] will change year to year based upon new construction, new or removed tax abatements, and tax certiorari decisions,” she said. “The county tax levy is spread among all municipalities in proportion to their share of the full of all property within Albany County.”

Unlike many other states, New York doesn’t have a uniform assessment standard, meaning that it’s up to each municipality to keep property values up to date. This is most frequently done on an incidental basis as assessors carry out other responsibilities, like evaluating new structures.

The alternative is a municipality-wide revaluation. Labor-intensive and politically unpopular, that process distributes the tax burden more evenly across the properties in a municipality, raising taxes for some while lowering them for others.

To accommodate the fraying that’s inherent without a single standard, New York State assigns each municipality a factor called the equalization rate that makes it possible to derive a standardized full-market value from the local assessed value. These rates are updated every year by the Office of Real Property Tax Services.

“A slight change in an equalization rate can cause a significant change to the full value of a municipality,” Rozak told The Enterprise. “Equalization rate changes often have the biggest impact on a municipality’s share of the county tax levy.”

The equalization rate is key when working the calculations backward because, looking at the change in assessed value in each town alone doesn’t reveal any clear relationship to the change in county tax rate.

For instance, both Westerlo and Knox saw an increase of half-a-percent in their property values between 2022 and 2023, but Westerlo’s county rate increased 5.8 percent while Knox’s went down by 2.7 percent.

However, with a much lower equalization rate (.64 to Knox’s 39), Westerlo properties have to be multiplied much more to reach their full-market value, meaning that their half-a-percent increase in assessed value reflects an 18-percent increase in full-market value, while Knox’s full-market growth is only around 8 percent.

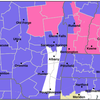

The full-market value of all the taxable properties in Albany County went up by 11.5 percent, so the towns whose full-market growth exceeded that — Berne, Rensselaerville, and Westerlo — saw increases in their tax share proportional to that growth, while Guilderland, New Scotland, and Knox had more modest growth and saw their rates go down as their proportion of the county total diminished.