County legislature unanimously adopts $757M tax-cut budget

ALBANY COUNTY — In a unanimous vote on Monday, the Albany County Legislature adopted County Executive Dan McCoy’s 2023 budget, which features an 8-percent tax cut with spending up slightly.

The 2023 budget totals $757 million, which is up about 6 percent from this year’s $715 million budget, and about the same as what McCoy presented in October.

Those totals do not include interfund transfers, which are listed as a major appropriations category but — because they are counted once when the transfer is made and again when the recipient department ultimately spends it — do not accurately reflect actual spending, according to the executive budget document.

Republican legislators, who make up a minority of the 39-member legislator, all voted against the 2022 budget, arguing that it didn’t do enough to save money for taxpayers.

This year, however, Republicans are pleased with the steps taken by the majority to address their concerns.

Republican Legislator Mark Grimm, representing part of Guilderland, wrote in a statement that “one of the best things you can do for constituents is let them keep their own money,” and expressed appreciation for McCoy, who is a Democrat, and his Democratic colleagues for their collaboration and compromise.

He also wrote that the budget “makes a big commitment to those who need it most,” and that he hopes tax rates will continue to go down.

Grimm told The Enterprise this week that “mental health emphasis is one of the best things about the budget,” which includes funding for the ACCORD (Albany County Crisis Officials Responding and Diverting) and MOTOR programs, both of which are mobile-response projects.

As for compromises, Grimm said he was happy that two department requests — funding for 15 new positions from the district attorney’s office due to work related to bail reform, and personnel raises from the sheriff’s — were not accepted at face value.

Of the district attorney’s request, Grimm said, “Though the [bail reform] mandates are unfair and frustrating, the legislature did not find the requests realistic for one department, especially given previous increases granted to the office.”

Of the sheriff’s raises, he said, “It was felt that would be problematic given that the county is now in the process of negotiating contracts, including salaries, with nearly all of its unions.”

A press release from the office of the legislature highlights spending in the budget toward economic development, such as funding for the Advance Albany County Alliance, a group that aims to help businesses grow their workforces and solidify their foundations, and also offers loans to tech companies.

The release also highlighted funding for a county-wide beverage trail that the legislature hopes will encourage tourism through the county’s craft drinks industry.

In addition to economic initiatives, McCoy highlighted money put toward renewable energy development through the Sustainable Technology and Green Energy Act, which was passed earlier this year.

Grimm also praised money for the STAGE Act, calling it “forward thinking.”

“We just have to ensure these investments produce clear, practical outcomes that benefit us,” he said.

The proposed 2023 budget document does not offer up any specific economic projects for next year, but celebrated the $100 million the county put toward Plug Power, its assistance to the African American Cultural Center as it purchased a property to address food insecurity, off-shore wind initiatives, and projects designed to address invasive species in county lands.

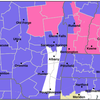

A major expenditure that affects local municipalities, and particularly the Hilltowns, is $130 million in sales tax distribution, which is more than the $117 million that was anticipated to be distributed this year. Sales tax is distributed to municipalities based on population, and can make up a huge portion of certain towns’ local budgets.

The amount also outpaces what the executive had predicted the 2023 expenditure to be in this year’s budget, which offers a three-year outlook.

However, the state’s comptroller, Thomas DiNapoli, has noted in his most recent sales-tax analysis that tax collections are up because of inflation and stated that inflation also continues to increase costs for many municipalities, warning “it is important that local officials recognize that changing economic conditions may impede future collections.”

Of the major appropriations categories, spending also went up in personnel and Federal Insurance Contributions Act payments, state retirement, Medicaid, debt service, community college, and the miscellaneous account.