School tax burden shifts to other towns because of Guilderland certiorari cases

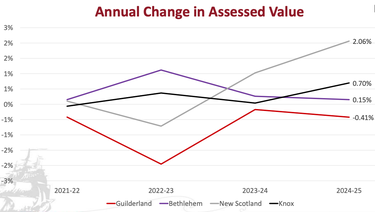

— Graph from Andrew Van Alstyne’s Aug. 13, 2024 Guilderland School Board presentation

While assessed property value in Guilderland, represented by the red line, has declined, largely because of tax certiorari cases, property values have increased in Bethlehem, in purple; Knox, in black; and New Scotland, in gray.

GUILDERLAND — The school board here has set tax rates for the 2024-25 school year that shift some of the burden to Bethlehem, New Scotland, and Knox because of successful assessment challenges in Guilderland.

While Guilderland’s rate is up 3.57 percent, the tax rates in New Scotland and Bethlehem are up well over 5 percent.

The tax levy for this year’s $125 million budget is up 3.5 percent from last year to $83 million. At the same time, according to the Property Tax Report Card, enrollment has increased by 20 students to 4,870.

The district’s levy is below the state-set levy limit, frequently called the tax cap.

Assistant Superintendent for Business Andrew Van Alstyne explained to the board at its August meeting that the Guilderland Public Library, a school district library, is spending money to pay down a capital project debt but those payments are subject to the library’s tax cap, not to the school district’s tax cap.

He also explained why the four towns with property in the Guilderland school district don’t have the same tax rate.

“In New York state, assessments are not done each year, right? So there are some towns that go years and decades between assessments,” said Van Alstyne.

Consequently, he went on, the state sets an equalization rate “to create a full-market value for each town so we can compare apples to apples rather than apples to oranges.”

Among the four towns, Guilderland was assessed the most recently, five years ago; Bethlehem, 10 years ago; New Scotland, 18 years ago; and Knox, 27 years ago.

Hence, Van Alstyne noted, “Eight-two percent is the amount applied to Guilderland, whereas 38 percent is the amount applied to Knox.” Bethlehem, at 71 percent, and New Scotland, at 70 percent, fall between.

Guilderland has the lion’s share of property within the district and therefore has the greatest share of the levy. Guilderland has $4.8 billion worth of property in the district at full-market value while, in round numbers, Bethlehem has $380 million, Knox has $38 million, and New Scotland has $23 million.

Since the 2020-21 school year, the property value in the district has decreased from $4.4 billion to $4.2 billion this year.

“It’s a significant decrease …,” said Van Alstyne. “So this is almost all because of the tax certiorari cases.” Almost all of those court challenges have been for property in Guilderland.

As a result, Guilderland’s share of the levy has gone from 92.68 percent to 91.61 percent.

“So the other towns have to make up a greater share of the levy,” said Van Alstyne. “So all three towns — Bethlehem, New Scotland, and Knox — have experienced a larger share of the levy distributed among their property even though they have a relatively small share of the overall property.”

He concluded, “So Guilderland is a town … with decreasing valuation but also a decreasing share of the levy. So those are both at play in terms of the tax rate.”

In Guilderland, estimates of taxable value made in April before the budget vote, have fallen by about $16 million to $3.9 billion, and the tax rate per $1,000 of assessed value is now set at $19.28, an increase of 3.57 percent.

“The reduction in taxable valuation more than offsets the reduction in the tax levy resulting in the larger tax rate increase,” says Van Alstyne’s analysis.

In Bethlehem, the tax rate is $22.27 per $1,000 of assessed value, an increase of 5.55 percent. “The increase in taxable valuation is offset by the share of the tax levy, which results in a significant tax rate increase,” says the analysis.

Similarly, in New Scotland, with the same analysis, the tax rate is $22.59, an increase of 5.63 percent.

In Knox, the tax rate is $41.61 per $1,000 of assessed value, an increase of 2.55 percent. Van Alstyne’s analysis says, “The increase in taxable valuation offsets the increase in full valuation, which results in the smaller tax rate increase.”

The tax rates for the Guilderland Public Library, per $1,000 of assessed value, are: $1.02 for Guilderland, $1.17 for Bethlehem, $1.19 for New Scotland, and $2.19 for Knox.

Board President Blanca Gonzalez-Parker cited an Aug. 2 article in The Altamont Enterprise, “In series of lawsuits, Guilderland property owners look to slash tax bills.”

“It talks about 60 properties asking to lower their assessment from $43.7 million to $14.2 million,” said Gonzalez-Parker, asking Van Alstyne if this could change rates again.

“It’s kind of fluid … and there’s no statute of limitations on this?” she asked.

“It will not affect the tax bills that go out this month,” replied Van Alstyne. “Any [successful] challenges to the assessment would result in refunds.”

He went on, “The process can play out in a number of ways.” Sometimes, he said, the district agrees with a claim and doesn’t challenge it. Other times, the district negotiates or, still other times, the district cooperates with the town on a joint defense.

The story, by Sean Mulkerrin, began, “There are fewer suits than in years’ past and certainly no eye-popping requests like slashing an assessment by $162 million, but the town of Guilderland is once again facing multiple lawsuits from landowners looking to collectively reduce the assessed value of their properties by millions of dollars.”

“We literally got one of the claims today that was mentioned in that article,” Van Alstyne said on Aug. 13, adding, “They are nowhere near the scale of the last wave.”

“That’s good news,” said Gonzalez-Parker. “Please tell me when to panic.”