Albany County gets mixed message from state sales tax report

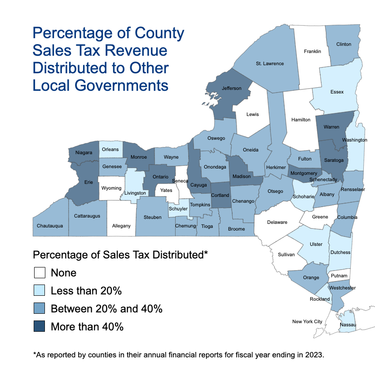

— map from New York State Comptroller's Office

This map shows the percentage of sales tax that each county in New York State delivers to its sub-muncipalities. Contrary to popular belief, municipalities in New York State — with only a few exceptions — don't generate their own sales tax revenue, instead receiving a share from their county based on population.

ALBANY COUNTY — A glowing report on the state of sales tax in New York for the first half of 2025 by the state comptroller casts a somewhat dimmer light on Albany County, where collection is growing at a much slower rate than most of its Capital Region neighbors and the state as a whole.

The county saw its sales tax collection increase in the first half of the quarter by 1.1 percent compared to the same period last year, according to the report, for a total collection of $183.5 million. That’s compared to a regional increase of 3.3 percent, and a statewide increase of 3.7 percent.

Within the Capital Region, Albany County outperformed only Warren County, which saw a decrease of 1.1 percent. Schenectady County saw the greatest increase, at 8.4 percent.

Because sales tax in Albany County retains 60 percent of the 4-percent sales tax it collects and distributes 40 percent to municipalities based on population, the total amount collected is an important figure for community leaders who have crafted their budgets in the preceding fiscal year within an expectation that sales will hit a certain level.

Sales tax typically makes up a huge chunk of a local municipal budget, particularly in the Hilltowns, where it hovers around half of all accounted revenue, including property taxes.

It was one of the major focal points during th COVID-19 pandemic, when lockdown orders and personal health decisions kept many from making their usual purchases, contributing to a 12 percent drop in sales tax collection in the state during the first half of 2020, the report shows.

It has bounced back in 2021, when the strictest mandates were lifted, and has been on the rise ever since. But while first-half collection had been increasing in terms of total value, the rate of growth had been dropping each year, with 2025 now marking the first year there’s been an increase in the growth rate since 2021, and since 2018 before that.

Albany County Commissioner of Management and Budget M. David Reilly Jr. told The Enterprise in a written statement that the reported growth “is tracking along with our own budgeted estimates.”

“Our local economy is in the midst of a transition,” he said, “with several key redevelopment projects currently underway that are poised to generate significant long-term economic growth. From the redevelopment of the former College of Saint Rose Campus to the demolition of the Central Warehouse, these projects represent a strategic long-term vision.

“Once completed, they will ultimately bring new businesses, jobs, visitors, and ultimately stronger revenues. We’ve been laying the groundwork for sustained growth, not just short-term spikes, and I’m confident that the investments we are making today will deliver a more resilient local economy for our residents.”

In any event, a wider look shows that, from a sales-tax perspective at least, Albany County is still the place to be in the Capital Region.

The most populous county in the region with roughly 315,000 residents, Albany County is also the biggest collector of sales tax, capturing 35 percent of all sales tax across 8 counties and two cities — Saratoga Springs and Glens Falls — that collect their own sales tax rather than receiving a portion from their respective counties.

But population size is not the only driver for this, since Albany County generates disproportionately more sales tax than even commercially bustling counties like Saratoga.

Per capita, Albany County collects roughly $583 per capita in sales tax. Saratoga (including Saratoga Springs), meanwhile, collects just $398 per capita.

As The Enterprise has previously covered in depth, the county benefits from being home to the only two indoor shopping malls in the entire region — Crossgates in Guilderland, and Colonie Center in Colonie.

The comptroller’s report notes that unemployment rates can be a factor in sales-tax collection, though Albany County’s, at 3 percent, does not stand out from the rest of the region.

The report goes on to warn that sales tax may soon be affected by “significant fiscal policy changes” at the federal level under President Donald Trump, particularly higher tariffs on imported goods in ways that are difficult to foresee.

It says that “while there has not yet been a widespread impact on consumer prices, tariffs could drive up prices and therefore sales taxes on purchases, but higher prices may cause consumers to shift their spending in ways that could lower collections.”

State Comptroller Thomas DiNapoli said in a statement as he issued the report, “While New York’s local sales tax collections experienced stronger growth in the first half of 2025, future revenues may become less predictable as local communities weather federal policy changes, inflation and other economic factors. Local officials should continue to take advantage of all the financial tools and guidance my office has to offer to help them strengthen their finances and resiliency amid these uncertain times.”